Banking Services

First Commerce Bank Mobile Banking is the ultimate on-demand service. With it, you can now conveniently monitor your accounts using your web-enabled mobile phone anytime and anywhere!

*Note: You must be enrolled in Online Banking to sign up for Mobile Banking.

At First Commerce Bank we offer a MasterCard® Check Card for your banking convenience. With this card you may access your account at most point-of-sale terminals and ATM's to purchase goods, pay for services, or get cash at anytime - day or night - inquire about your account balances, and transfer funds between checking and savings. (Some fees do apply at terminals we do not own/operate.)

The MasterCard® Check Card is not a credit card, but rather is used in place of writing a check. The amount purchased or withdrawn is deducted directly from your checking account. Transactions will appear directly on your checking account statement.

If your debit card is lost or stolen, please call 1-800-500-1044 immediately.

With First Commerce Bank's remote deposit system, your business can make deposits from miles away without ever leaving your place of business. Simply scan, submit, and deposit your checks electronically.

Please contact us at (931) 359-4322 for more information. Let First Commerce Bank go to work for you with our remote deposit system.

First Commerce Bank is proud to offer a merchant card program to our small business customers. This program enables small business owners the opportunity to be more competitive with expanded payment services. For more information, please see any First Commerce Bank customer service representative.

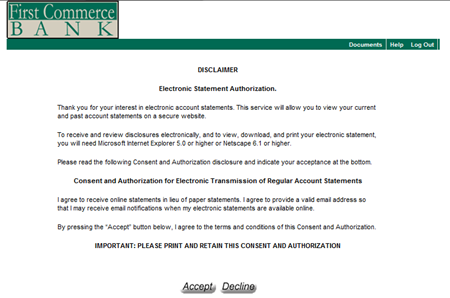

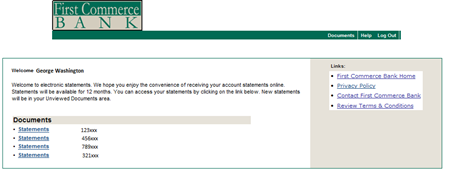

We do our best to limit our use of paper whenever possible. Receiving your bank statements electronically is a great way to save paper and other resources. It is also a good way to help protect your private financial information. Did you know that the majority of ID theft today occurs as a result of someone intercepting your traditional mail or by someone accessing your improperly discarded documents! In addition to securely disposing of your private financial records, receiving your bank statements electronically will help reduce your risk of becoming yet another victim of this all-too-common crime. Once you sign up, you will have access to 12 months of statements online in which you can print or download for safekeeping.

At First Commerce Bank, we realize the impact we can have on our environment, and we do our best to limit our use of paper and other consumables whenever possible. We have invested considerable resources in technology and are striving to become more "paperless" in our day-to-day processing. We hope you will consider banking electronically whenever possible.

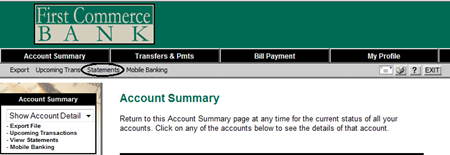

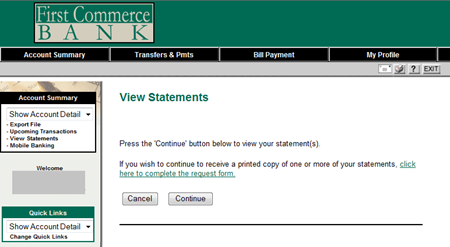

Please follow the short few steps below and you will be “Paperless”!

*Note: You must be an Online Banking Customer to retrieve statements electronically.

4. Your accounts will be displayed from which you can bring up your statements by clicking the word Statements for each account. That easy!

</p>

</p>

-

Link your existing checking account to another First Commerce Bank account.

-

Available funds are automatically transferred to cover incoming transactions.

-

Sweep accounts could have an effect on FDIC deposit insurance limits. See a bank employee with any questions.

Fees: There is no additional fee associated with Sweep Accounts**

** If there are no available funds to be transferred, you may still incur fees.

- Convenient

- Faster Processing Time

- Secure

- Efficient

- Cost Savings

For questions regarding ACH Origination, please reach out to a First Commerce Bank employee.

First Commerce Bank is a participant in the IntraFI network.

For more information about the products available as part of the IntraFI network, please contact a First Commerce Bank employee.

- Convenient

- Local

- People you know and trust

- Ease of in-house loan closing

Miscellaneous Fees

The following fees may be assessed when applicable.

| Service | Fee |

|---|---|

| Balancing Customers Checkbook | $20.00 (per hour) |

| Printing of Customer Statements | $2.00 each |

| Dormancy Fee for Checking Accounts 18 months | No Activity | Balance of <$15 |

$3.00 |

| Dormancy Fee for Savings Accounts 24 months | No Activity | Balance of <$15 |

$3.00 |

| Fax Transmission | $2.00 per fax |

| Garnishments & Levies | $25.00 |

| Official Check | $5 (per check) |

| Research | $20 (per hour) |

| Safe Deposit Box Drill If both keys are lost, box has to be drilled |

$175.00 |

| Safe Deposit Box Drill Change Lock Only - 1 key lost |

$110.00 |

| Replacement Locked Deposit Bag | $15.00 |

| Stop Payment | $20.00 (per item) |

| Wire Transfer Outgoing & Incoming Domestic |

$15.00 |

| Wire Transfer Outgoing & Incoming Foreign |

$40.00 |

| Service | Fee |

|---|---|

| Debit/ATM Card Replacement Fee | $15.00 |

| Returned Item Fee | $33.00 each |

| Overdraft Paid Item Fee | $33.00 |

| Regular Checking Account Fee If account falls below $500 |

$9.00 |

| eVue Checking Monthly Service Charge Waived by viewing statements online |

$5.00 |

| Commerce Club Account Fee | $11.00 |

| President's Club Account Fee If account falls below $1,000 |

$11.00 |

| Christmas Savings Account Fee After one withdrawl |

$11.00 |

| Rate Climber Money Market Account Fee If account falls below $2,500 |

$11.00 |

| Business Checking Account Fee If account falls below $500 |

$9.00 |

| Business Interest Checking Account Fee If account falls below $1,000 |

$11.00 |

| Business Money Market Account Fee If account falls below $2,500 |

$11.00 |